Analysis of Byju Raveendran’s FIR and bankruptcy case

Byju Raveendran Files FIR, founder and CEO of India’s largest edtech startup Byju’s, is currently facing serious legal and financial troubles. The FIR filed by him and the bankruptcy process of the company have also given rise to widespread discussion. This case is not just a question of the collapse of a company, but also shows how personal and institutional interests collide among many stakeholders.

Byju Raveendran Files FIR naming former resolution professional Pankaj Shrivastava, employees of EY and representatives of glass Trust

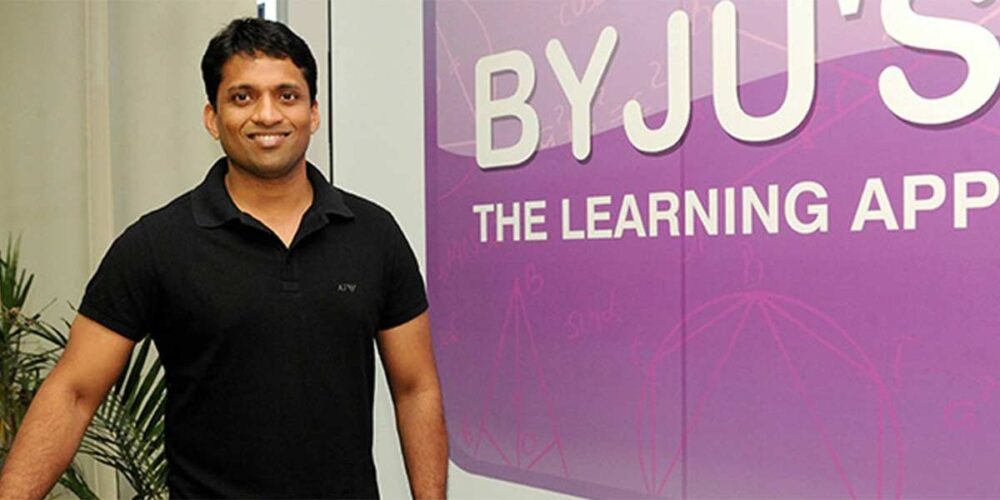

Who is Byju Raveendran?

Byju Raveendran brought the online learning revolution, which expanded not only in India but also abroad. He has also received honors like EY’s Entrepreneur of the Year (2018 and 2020). But today the same person is surrounded by legal troubles, where questions are being raised on his leadership and the company’s financial decisions.

What is the bankruptcy case?

The company had also taken a term loan of $ 1.2 billion, which was used to expand abroad. But the company shut down and defaulted on loans due to operational difficulties. The lenders then approached the NCLT (National Company Law Tribunal), which put a stay on Byju’s financial decision-making and gave the lenders the rights.

What are the allegations in the FIR?

Raveendran has accused EY India, Glass Trust and former RP Pankaj Srivastava of “criminal conspiracy” in the FIR. He says that these people together manipulated the bankruptcy process, in which Byju was suppressed.

What are the allegations against EY, Glass Trust and Srivastava?

EY is a renowned auditing firm, but according to the whistleblower, they worked against the interests of the company in connivance with Glass Trust. Glass Trust, which represents lenders, is accused of prioritizing the interests of creditors and ignoring Byju’s unresolved disputes. Pankaj Srivastava is also accused of being biased in favor of lenders, which is against the role of an impartial RP.

What is the justification for filing the FIR?

Raveendran took this step after he said that Glass Trust and EY not only ignored the company’s side during the restructuring but also deliberately took decisions in favor of the other party. A whistleblower from EY also made it clear that some evidence that could prove misconduct was suppressed internally.

The entire case shows how a lack of coordination between individual and institutional principles can lead to serious problems when multiple parties are involved in a process like bankruptcy. This case will not only affect Byju’s future but will also raise serious questions on the standards of auditing and corporate governance.

Meaning of the statement: “Not flowers, I am fire”

Byju Raveendran announced his resolve by saying: “Not flowers, I am fire.” This impressive statement reflects his critical and competitive spirit, where he is taking a strong stand against third-party advisors like EY and Glass Trust, who are accused of political and unethical behavior.

Many are seeing this announcement as a turning point, where Raveendran is determined to save his company, reputation, and vision.

What impact will the FIR have on Byju’s bankruptcy process?

This FIR adds another layer of complexity to an already complex bankruptcy case. If the allegations are found to be true, the current strategy being led by lenders and Glass Trust may be affected. Also, regulators like RBI and NCLT may have to reconsider Byju’s restructuring program and lender agreements.

What could be the legal consequences for the accused parties?

If EY and Glass Trust are proven guilty of collusion, misrepresentation and fraud, they could face heavy penalties, EY could be suspended from auditing and their reputation could suffer severe damage.

Pankaj Srivastava as an individual could face punishment ranging from a fine to imprisonment, depending on the severity of his role.

Public response and investor sentiment

The controversy has shaken public confidence, and there has been a mixed response within the investor community. Some investors are demanding accountability, while others see it as a distraction from core business issues – such as user retention and profitability.

Journalists reporting on corporate governance have exposed numerous contradictions and conflicts of interest in the bankruptcy process, leading to even tighter scrutiny of external advisers.

Discussions are also rife on social media – people are asking if Byju’s rapid growth has come at the expense of financial oversight?

Signs for Byju’s and Indian startups

The entire incident is being seen as a warning – especially for Indian startups that want to grow quickly without strong auditing and financial controls.

The road ahead for Byju’s may be difficult, but if this crisis is overcome, it could give its business a new direction.

The case has also raised questions about the role of advisors like EY and Glass Trust, who feel the need for new thinking on values like transparency and accountability.

Next steps for Byju Raveendran and company

Will Byju’s be able to overcome this crisis and win back trust? The answer is not yet clear, but Raveendran’s forward stance shows that he is committed to his company’s values and future.

The outcome of this legal battle will affect Byju’s restructuring, public image and investor trust – and it can also serve as an example for other Indian startups on how to deal with such crises.

Also Read : Mudra Yojana Impact & Benefits | Empower Small Indian Businesses

Join Us : Facebook

One thought on “Byju Raveendran Files FIR Amid Insolvency Case”